After a dismal record of failure, the enthusiasm of the ideological extremists in the Turnbull government for Free Trade Agreements is as strong as ever. They are now proposing that Australia signup to a Free Trade Agreement with the EU protectionist trading bloc. No doubt another large chunk of Australia and the interests of future generations will be sold off as a consequence.

This week, Mr Steven Ciobo, the Minister for Trade, Tourism and Investment excitedly announced that the Council of the European Union had agreed to open negotiations for a “landmark job creating” Australia-EU trade agreement.

As is usual with FTA announcements we have been promised that signing a FTA with the EU will deliver endless benefits to Australia.

As usual the announcement fails to mention any of the fundamental flaws that have infected all of the recent FTA “sell out” deals that the LNP have stitched up. Sadly DAFT seems to take the view that its job is to “sell” whatever crazy schemes the government dreams up.

This is what DFAT has to say about a FTA with the EU?

They even provide one of their ever helpful “fact sheets” so we can take a closer look at recent Australia-EU trade performance.

When it comes to merchandise – it is a one way street

As far as merchandise trade is concerned Australia ran a whopping deficit of over $30B in 2016/17 alone. But then the whole point of the EU is as a protectionist trade bloc so is it really any surprise that they are not very keen on buying our exports.

Now you might be wondering why Australia would be so keen to buy so many European exports including $6.6 billion worth of European made cars (though we don’t have much choice now that the Liberals have shut down Australian car manufacturing) when they seem so uninterested in allowing our exports into the EU markets. The answer of course is that the EU has been blocking our exports and we have not been blocking theirs. Canberra has been selling us out to the EU for decades.

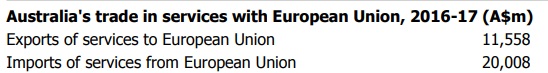

What about services?

The trade in services is not much better with imports from Europe exceeding our exports by $8.5B. That means the deficit in 2016/17 for merchandise and services was almost $40 billion.

What about investment?

The investment ledger tells the other side of our hopelessly one sided relationship with the EU protectionist trade bloc. If you are running a massive trade deficit like the one we have been running for many years with the EU you need to have some way of paying for all those imports.

The following are the two main ways you can pay for a trade deficit:

- Sell title to assets to your trade partner

- Borrow money from your trade partner (a bit like using a Myer card to go shopping at Myer)

So lets have a look at the ‘investment’ relationship figures provided by DFAT

Yep you read them right.

The difference in the total is $461 Billion and $60B in FDI.

Neither number should be much of a surprise considering we ran a deficit on merchandise and services of almost $40B in 2016/17 alone. $461 billion means a lot of Australian companies and other assets owned by members of the EU.

BUT BUT BUT – The Australia – EU – FTA will fix all that.

Complete and utter nonsense

That is what Mr Steven Ciobo wants you to think but does anyone seriously believe the EU have any desire to change the current state of play where they run a $40B surplus every year and then use that surplus to buy up our assets and claims on our future income?

The EU was set up to protect the jobs, industries and other interests of the members of the European Union and quite clearly it has been doing an excellent job, at least where trade with Australia is concerned.

And just in case you think the EU are about to cancel all their fondue parties to help Australia improve its trade performance with the EU have look at the status of Australia as destination for EU exports or source of EU imports.

1.8% for exports from the EU and 0.8% for imports to the EU.

We simply don’t rate.

So what do the EU want? Why would they bother?

There are a couple of reasons why the EU might bother to spend the time playing the FTA game with Australia.

The most likely reason is that they want to put political pressure on the United Kingdom during the Brexit negotiations. They know that talking about a FTA with Australia and New Zealand while talking tough with the UK (and threatening their access to the EU trade bloc) will put a lot of psychological pressure on the UK Government. Smart politically and it will cost them little as they know they will be able to give Australia next to nothing to get a desperate dunce like Mr Steven Ciobo to sign up.

The next most likely reason is that they have noticed the track record of the Australian Liberal National Party Government and how good they are at signing up to dud FTA agreements that sell out the interests of Australians.

Plus they would know the standard formula for a deal that the Liberal National Party will agree to

- Offer trivial improvements in reduced tariffs and ‘access’ to EU markets for some National Party commodities (a bit more beef and sugar) and stage those improvements over 5 – 20 years. In this regard note the way the Chinese, following our China-FTA are now blocking Australian wine on the docks of Chinese ports using some bogus admin excuse as a pretext. Offering improved access that never quite happens is standard fare for the FTA agreements that Australian politicians happily sign.

- Demand unrestricted freedom to drive unproductive capital into Australia and by doing so push up the Australian exchange rate and push down the Euro. By unproductive capital inflows we mean capital flows that do not directly and explicitly result in an expansion of the productive capacity of the Australian economy. Examples of unproductive inflows include, purchases of government bonds, mere transfers in title of Australian assets, purchases of banking system liabilities that are used to support the supply of mortgages secured by existing property. Ironically freedom to pump unproductive capital into Australia is essentially what Australia gave China in return for better access to the Chinese market for ‘wine’ amongst other things. Have you noticed any shortage of Chinese made goods on the shelves of Australian stores? No I didn’t think so.

- The EU will not even have to demand unrestricted freedom to export goods and services to Australia because they already have unrestricted freedom, in the form of a $40B trade surplus, to export to Australia. In that respect we have nothing to offer.

The net result of what are likely to be even less regulated unproductive capital inflows under any AUS-EU-FTA is that the AUD will be more overvalued (and thus form an effective tariff on Australian exports) and even if Australian exporters manage to over come the inflated AUD barrier, they will struggle to get through the forest of red tape that Brussels’s paper shufflers are champions at deploying to stop whatever it is they want to stop.

So why does Malcolm Turnbull and Steven Ciobo want a FTA with the EU?

The following are some of the most likely reasons that the Liberal National Party government are so keen to sell out Australia to foreign interests with dud FTA agreements.

- They think signing FTA agreements makes them look like they are doing something. Sadly there is some truth to this as most of the Australian media are too lazy or too ignorant about trade and capital flows to really question the wisdom of signing FTA agreements. So most members of the public assume something good is being done.

- The Liberal Party key sponsors are banks, the financial sector and the industries – real estate, finance brokers and deal making (lawyers and accountants) that make fat profits from the unproductive capital inflows and the parts of the economy stimulated by them, i.e. the residential housing bubble.

- The National Party are shameless in selling out the broader national interest just so a few farmers can sell trivial additional amounts of a few commodities into the EU … assuming of course that the EU don’t find some cunning way of reneging on the deal in practice.

- Ideological obsessions about Free Trade as being the solution to every problem. The ideological Free Trade fanatics (and there are few in the ALP as well) always ignore the critical issue of unregulated or Free Capital Flows. Though this oversight is likely to be no accident.

But isn’t Free Trade a good thing?

In principle allowing people more freedom to buy goods from wherever they want and whenever they want IS a good thing, unfortunately life is not quite that simple.

If we ignore the way that capital flows are being used by our trade rivals to manipulate exchange rates and the treacherous willingness of our political and policy class to facilitate them, we will find that we do not have “free” trade at all.

What we will have are exchange rates manipulated by mercantilism and protectionist trade blocs and ‘trade’ which continues to be impeded by administrative barriers and hidden fees and taxes.

Sadly the simple fact of the matter is that if a country currently has direct tariffs on your goods and services or effective tariffs via capital flows they are unlikely to just give them up. Especially if you have already reduced your tariffs and barriers on their imports to you.

The best thing a country like Australia can do are the following and neither require any agreement to be reached with a trade partner.

- Carefully and closely regulate the major flows/ types of unproductive capital into Australia as this will protect Australia from exchange rate manipulation by trading partners and make it much harder for our politicians to sell us out.

- Unilaterally reduce tariffs on imported goods and services in whatever manner suits Australia. If a foreign country wishes to subsidise their exports and we don’t see any advantage in producing those products ourselves we may as well let the taxpayers of another country subsidise our standard of living. However, there are limits to this and we should not do so if that involves selling off our asset base and vast interest bearing claims on the incomes of our children.

Categories: Macrobusiness

Recent Comments