Another tough week for the Sydney property market and the delicate but immaculately dressed ecosystem that feeds on it. Hammer time hit a depressing 10% of listed auctions despite a week of constant propaganda from the banking / property media complex. And if that was not enough the Banking Royal Commission is back this week to bring cheer and hope to all those fed up with the current role of banks in the Australian monetary system.

The pressure on Treasurer Josh this week has been unrelenting, with all his dearest friends in the banking and wider commercial community ganging up to let him know that if he doesn’t start delivering some sweeties to the residential housing casino big players and soon, the economy will get it.

The tone of opinion columns in the banking industry advertorial supplements has become quite bizarre with one well seasoned commentator, ‘reporting’ from the front lines, that bank staff feel the Gestapo are after them. That bank staff liken an APRA wet lettuce leaf to the Gestapo pretty much sums up the reason we are having a Royal Commission.

Macrobusiness was kept very busy diligently monitoring the moaning and special pleading of the banking / property industry usual suspects all week. Here are just a sample:

- Another day, another worst ever negative gearing attack

- Another day, another worst ever negative gearing reform attack

- Gotti: Property bust to crash economy

- Wesfarmers blames everyone else for its housing suicide

Small business to borrow from the government because the banks and capital markets have better more profitable things to gouge.

One the strangest announcements during the week by the clearly stressed “Not Joshing” Josh was the announcement that the government is going to create a taxpayer backed $2 billion dollar securitisation fund to invest in small and medium (SME) enterprises.

Apparently Australia’s banking sector and capital markets are so incompetent, inefficient and lazy that they are incapable of supplying small and medium business with the financial services they need and the government has to step in to ensure that SME have access to credit and equity.

One might have thought that now is not the time for Australian banks and capital markets to be confessing that they can’t actually do what they are supposed to be ‘world leaders’ at doing.

On the bright side it at least confirms the growing suspicions that our major commercial banks are nothing of the sort and are little more than glorified building societies that prefer to use the privatised power over public money, their market share and public protection and guarantees to blow a massive and profitable residential housing bubble… at least when they are not billing dead people.

Royal Commission is back this week.

Further entertainment is promised this week as the Banking Royal Commission returns to ask tough questions of the private bank CEOs, such as why they should continue to have a privileged role within the public monetary system when they have demonstrated that they simply cannot be trusted and would not know a fiduciary duty if it bit them on their bonuses.

Actually that question might not be within the Terms of Reference but with a few squirts of WD-40, and a nod from Commission Haynes, Counsel Assisting might be able to touch on the following as well:

Ben Chifley’s assessment of private banking in his dissenting opinion in the last Banking Royal Commission in 1937.

The benefits of having the Reserve Bank of Australia introduce MyRBA deposit accounts for all Australians and non-banks.

The benefits of expanding the role of Central Bank liabilities in the Australian monetary system.

Hopefully it will be a good week to go long popcorn.

But now lets get to the Auction Action stats for this week.

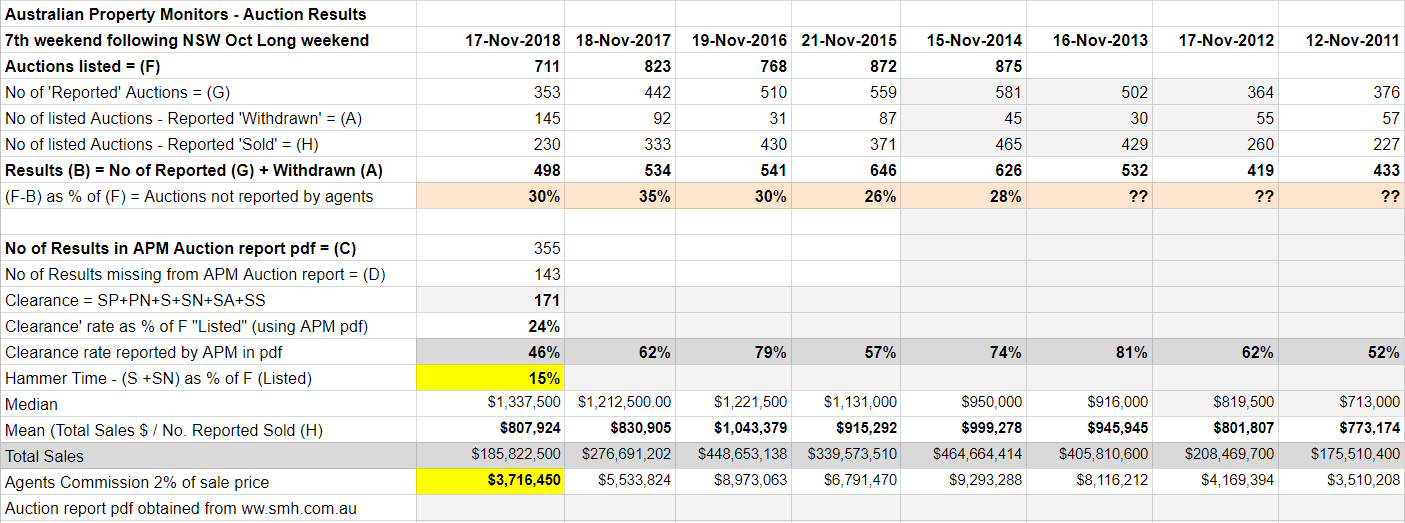

Table 1: Hammer Time – 7th week after October long weekend

Table 1 shows the totals for each auction result category in the APM pdf reported by Domain this week. Hammer time is the percentage of the listed auctions that were sold under hammer or shortly afterwards.

Only 10% of the listed auctions were sold under hammer this week with another 10% being sold before auction and 20% of all listed auctions being withdrawn.

Not a pretty sight.

Table 2 – Year on Year comparisons

Table 2 compares this weekend (the 7th weekend after the October long weekend) with the same weekend in the previous 8 years.

Agents were a bit lazy (or depressed) this week with 30% of listed auctions not being reported. A clearance rate of only 25% of the listed auctions was a new recent low. The average sale was just about $800,000 which is more than $200,000 less than the same weekend in 2016.

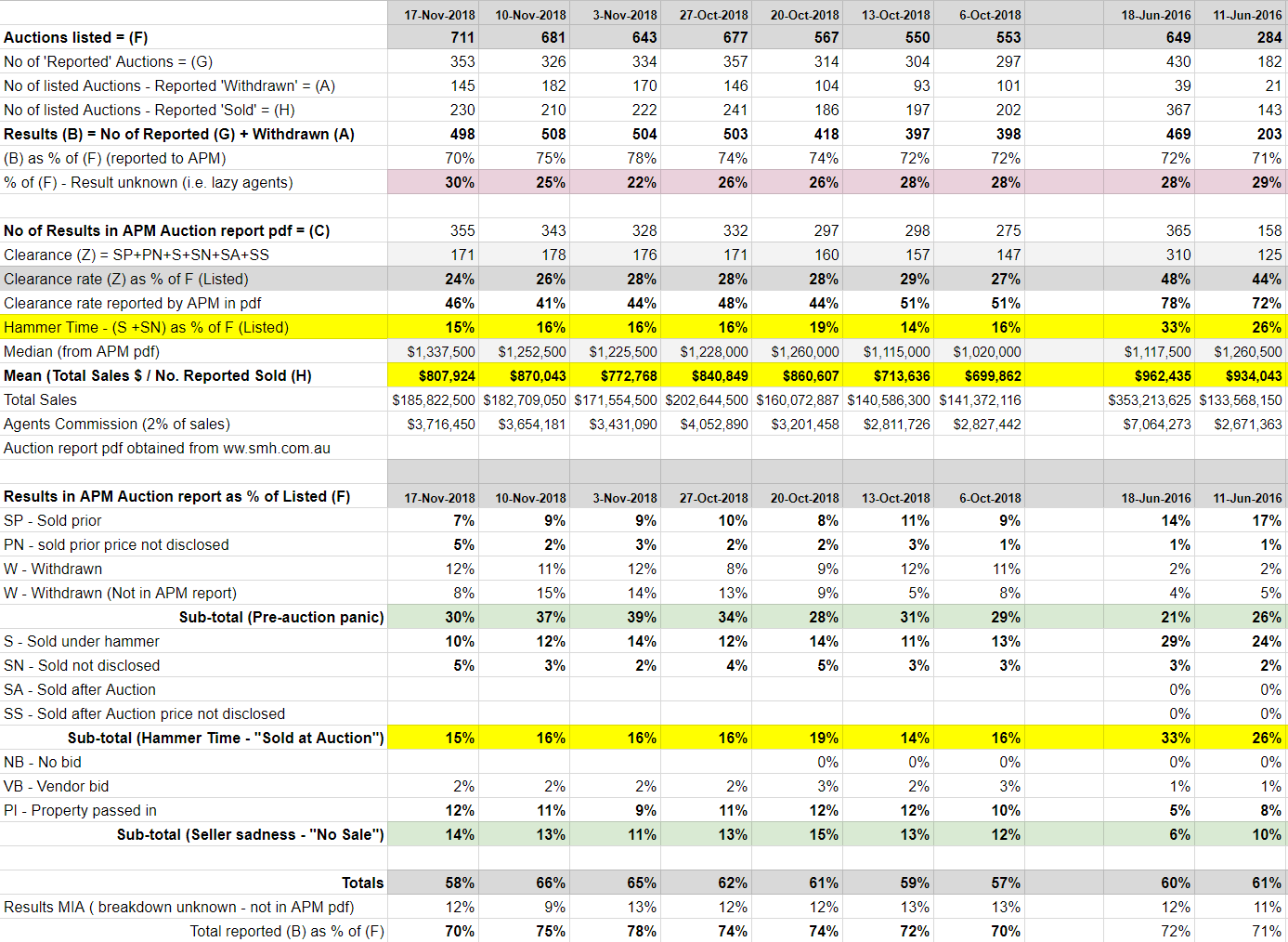

Table 3 – Summary

Table 3 is a summary of recent weeks of auction action. Some 2016 figures are included to remind us what the Sydney property market looked like with easy and cheap credit being sprayed in all directions by the banks.

Not exactly a joyful set of figures but with the Banker’s Bugle and the The UnAustralian running stories and op-eds every day designed to encourage renewed obedience from the banking regulators, the Royal Commission and the government and attention to the needs of their corporate banking sponsors, good times must be just around the corner.

Categories: Macrobusiness

Good stuff

LikeLiked by 1 person